Banks that Invest in Fossil Fuels Using Your Money

Do you know which banks are donating to the fossil fuel industry? We look at the Dirty Dozen, net zero promises, and how to make the switch to sustainable bank.

October 16, 2023

Let’s cut to the chase. The fossil fuel industry has received $5.5 TRILLION from the world’s top 60 banks in the last 7 years alone. And they’re funding these fossil fuel giants using customer’s money. Do you know which are the banks that invest in fossil fuels? Let’s talk about it.

Banking on Climate Chaos Report

The newest Banking on Climate Chaos Report has found that despite growing concerns about climate change and the push for cleaner, more sustainable energy sources, top banks continue to invest in fossil fuels.

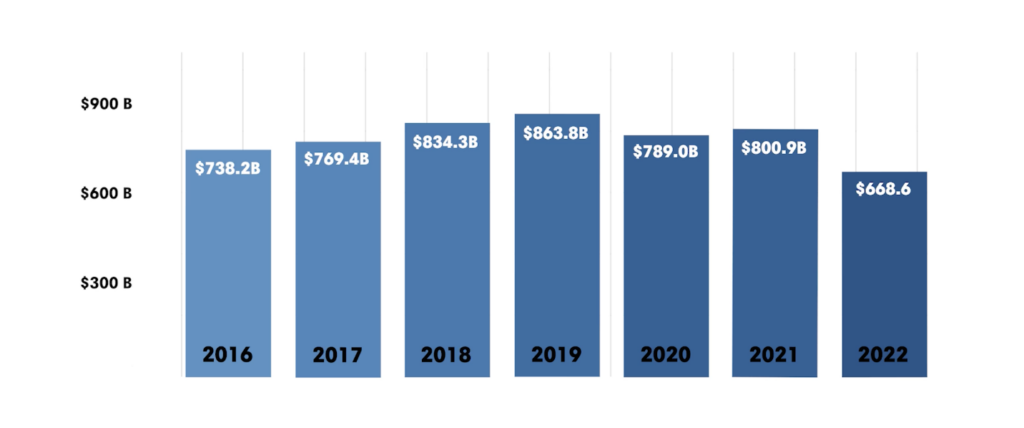

$5,500,000,000,000 – aka $5.5 trillion – has been poured into the fossil fuel industry in the last 7 years since the adoption of the Paris Agreement in 2015.

This amount is more than the USA’s military spending. And it is nearly the cost of converting the entire US electricity grid to renewable energy.

Of that amount, $668 billion was invested in 2022 and $800 billion in 2021.

Banking on Climate Chaos has a ton of details on the bank’s fossil fuel financing policies, investment breakdowns by year, and what fossil fuel companies got financed. We highly suggest you take a look for the complete picture!

Identifying Banks that Invest in Fossil Fuels

Although the report draws attention to the world’s 60 largest banks, they call out “The Dirty Dozen“. These are the 12 worst banks financing fossil fuels globally from 2016-2022.

- JP Morgan Chase: $434.1 billion

- Citi Bank: $332.9 billion

- Wells Fargo: $316.7 billion

- Bank of America: $279.7 billion

- RBC: $252.5 billion

- MUFG: $219.6 billion

- Barclays: $190.5 billion

- Mizuho: $189.6 billion

- Scotiabank: $182.3 billion

- TD: $173.2 billion

- BNP Paribas: $165.9 billion

- Morgan Stanley: $153.4 billion

Last year, oil and gas companies made $4 trillion in profits – thanks in part to the massive investments of their banking partners.

“Major US banks stalled on their net-zero plans and failed to adopt stronger and more robust financing restrictions for companies pushing unsustainable fossil fuel expansion,” said Adele Shraiman, senior campaign representative for the Sierra Club’s Fossil-Free Finance Campaign

Implications of Fossil Fuel Investments

So… what’s the big deal? The fossil fuel industry, which includes coal, oil, and natural gas, is directly linked to environmental degradation, air pollution, greenhouse gas emissions, and climate change.

Not to mention the threat to the lives and livelihoods of local communities globally – disproportionally harming Indigenous peoples, black and brown communities, and poor and working-class communities.

While many of these banks are making commitments to sustainability, or marketing sustainability initiatives (like implementing recycled plastic cards or donating to nonprofits), the truth is that they support fossil fuel companies behind the scenes.

In short – they’re lying to consumers, and not truly pursuing sustainability and social justice in a holistic and meaningful way.

By directing funds away from fossil fuels and towards clean energy projects, banks could play a significant role in the transition to a more sustainable future.

But, a spokesperson from the Net Zero Banking Alliance noted that this transition cannot happen all at once. An immediate divestment from existing fossil fuel positions would lead to “extreme market shocks” that could “profoundly impact the world’s most vulnerable people.”

So… while a shift must happen, it will have to be carefully crafted over many years.

Finding Cleaner, Greener Banking Alternatives

Hiding Bank Investments

If this is news to you, you’re not alone. Corporations go to extreme lengths to hide their unethical practices and shady investments from the public to avoid backlash and scrutiny.

And because there are SO many banks that invest in fossil fuels, it can be challenging to find a more sustainable alternative.

Especially while these banks are publicly marketing sustainability commitments. 49 of the top 60 banks that invest in fossil fuels also have made net zero commitments. Yikes!

To start, we suggest doing a deep dive on your current bank. There are a ton of resources out there – including Banking on Climate Chaos – to show you if they donate to fossil fuel initiatives, and what other sustainability commitments they might have made (like net zero!)

Mighty is another awesome tool here. They analyze public data for every bank, and present it to you in a straightforward way so you can make educated decisions.

Discovering Eco Banks

If you decide you want to switch banks, there’s a few ways to find one more aligned with your values.

- B Corp Banks: Certified B Corps meet third-party stands for social and environmental performance. By finding a bank that is a B Corp already, its pretty likely that they are dedicated to using their money and power as a force for good.

- Eco-focused neobanks: as more consumers want ethical banking services, a handful of digital-only neobanks have hit the market. They partner with community banks to offer you services. They typically have some meaningful sustainability commitments you might not find at a larger bank.

- Global Alliance for Banking on Values (GABV) Members: The GABV is a network of financial institutions that use finance to deliver sustainable, economic, social, and environmental development. They use a triple-bottom line approach, too!

Karma Wallet Card

The Karma Wallet Card is a prepaid, reloadable debit card that puts people and planet first.

Our debit card works through Pathward Bank, a bank that does not invest in fossil fuels and prioritizes social and environmental initiatives.

Instead, they invest in renewable energy initiatives – in 2022, they donated $320 million towards alternative energy projects.

They have also invested $61.3 million in community development investments that create positive impact on peoples globally.

An easy way to ensure you’re not supporting banks that invest in fossil fuels is by getting the Karma Wallet Card! Through Pathward, we’re able to ensure your dollars are going to meaningful alternative energy projects.

The more you know about your bank, and how your money is being used – the better. Avoiding banks that invest in fossil fuels isn’t easy, but more important than ever. Have you made the switch?